Suggested CitationĪll material on this site has been provided by the respective publishers and authors. Opportunities for further study are suggested. This is the ideal behavior one would expect of taxpayers who are left with more disposable income. Government revenue was more when comparisons were made between taxpayers in the income tax regime who made use of current tax shelters, and those in the consumption tax regime who maximized their investment. On the other hand, government revenue received from the average taxpayer in some scenarios is less when consumption tax replaces income tax, and is more in others. The study concludes that in any scenario, individuals are able to enjoy more total consumption and purchasing power over time, adjusted for inflation, when a consumption tax substitutes for income tax.

Comparisons are made between the two regimes in three scenarios to reflect different taxpayer behavior: holding investment steady, holding consumption steady, and maximizing the use of current tax shelters.

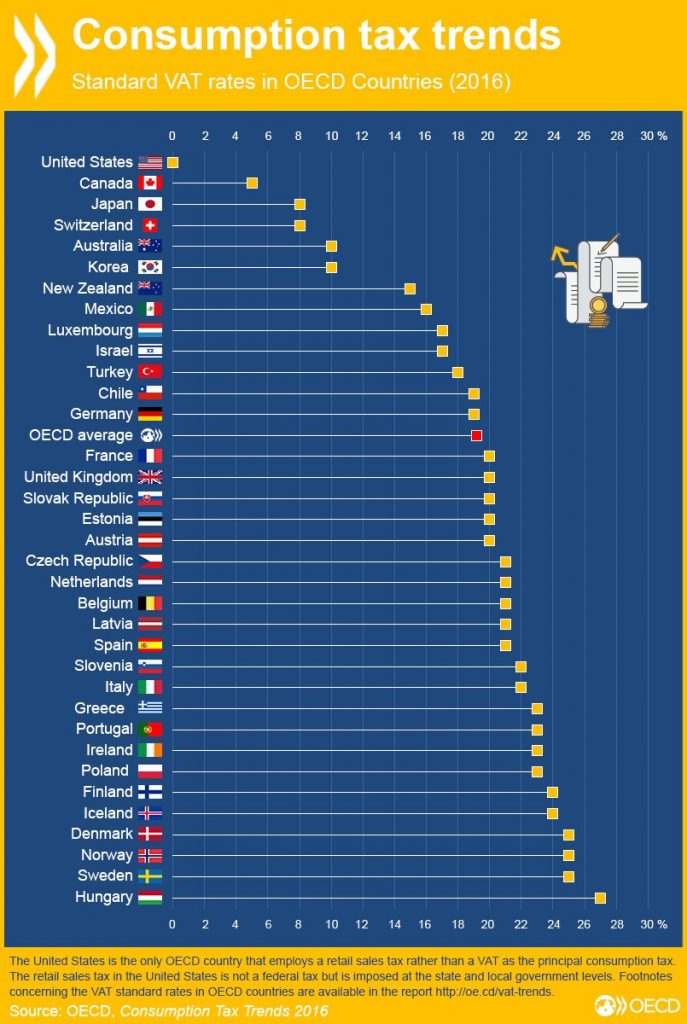

The rate of consumption tax is calculated to provide the equivalent amount of revenue the Canadian government currently receives. This study compares an average Canadian taxpayer in Canada?s current hybrid tax regime with a taxpayer in a hypothetical consumption tax regime. It is proposed that when consumption tax replaces income tax as the means of financing the state, investment increases, individuals are able to consume more over a lifetime, and levels of government revenue can be maintained. Despite these claims, no state has opted to replace income tax with consumption tax as the prime source of revenue. Consumption tax has been lauded as an alternative to income tax, in that it promotes savings and investment, and enables increased consumption over time.

0 kommentar(er)

0 kommentar(er)